Small business health insurance owner, you have countless responsibilities and decisions to make every day. From managing finances to ensuring customer satisfaction, your plate is always full. Providing health insurance for your team may seem like an added expense or hassle, but it can actually bring numerous benefits to both your staff and your business as a whole. Let’s explore why offering health insurance is crucial for small businesses and how it can help attract and retain top talent while promoting overall employee wellness.

The Benefits of Offering Small Business Health Insurance

As a small business owner, you know that happy, healthy employees are key to a successful business. Offering health insurance is one way to help keep your employees healthy and productive.

There are many benefits to offering health insurance to your employees, including:

Attracting top talent: A robust benefits package can help you attract and retain the best employees.

Increased productivity: Employees who have access to quality health care are more likely to be productive and present at work.

Reduced absenteeism: Employees who have access to health care are less likely to miss work due to illness or injury.

Improved mental health: Employees who have access to mental health services are more likely to be productive and engaged at work.

Understanding Your Options for Small Business Health Insurance

Small business owners have a lot to think about when it comes to employee benefits. Health insurance is one of the most important benefits you can offer your employees, but it can be confusing to understand all of the options available. This section will provide an overview of the different types of small business health insurance and help you determine which option is right for your business.

Group health insurance is the most common type of health insurance for small businesses. This type of insurance is typically offered through an employer and covers all employees who participate in the plan. Group health plans can be tailored to meet the specific needs of your business and can be very affordable, especially if you have a large number of employees.

Another option for small businesses is to purchase a private health insurance policy. Private health insurance policies are not connected to an employer and can be more expensive than group health plans. However, they may offer more flexibility in terms of coverage and may be a good option for businesses with a smaller number of employees.

Finally, there are public health insurance options available for small businesses, such as Medicaid or the Children’s Health Insurance Program (CHIP). These programs provide coverage for low-income individuals and families and may be an option for businesses that are struggling to afford private health insurance.

No matter what type of small business health insurance you choose, make sure you shop around and compare plans before making a decision. There are a lot of great options available, so take your time to

Advantages & Disadvantages of Offering Health Insurance to Employees

When it comes to offering health insurance to employees, there are both advantages and disadvantages that small business owners need to be aware of.

On the plus side, providing health insurance can help you attract and retain top talent. Employees value having access to quality health care, and knowing that their employer is helping to provide that can be a big selling point when choosing where to work. Additionally, offering health insurance can help create a healthy and productive workplace – studies have shown that employees who have access to quality health care are more likely to be productive and take fewer sick days.

However, there are also some downsides to offering health insurance. For one, it can be expensive – especially if you have a lot of employees or those employees have families that need coverage as well. Additionally, it can be difficult to find a plan that meets your needs and budget, and you may need to make some compromises in order to make it work for your business.

Types of Plans Available for Small Business Owners

There are a variety of health insurance plans available for small business owners to provide to their employees. The most common type of plan is a group health insurance plan, which is typically offered through an employer. Other types of plans that may be available include individual health insurance plans, which are purchased by the individual; family health insurance plans, which cover a family; and short-term health insurance plans, which provide coverage for a limited period of time.

How Much Does it Cost to Offer Employee Health Insurance?

Offering health insurance to your employees can be a great way to attract and retain top talent. But how much does it cost to offer employee health insurance?

The cost of offering health insurance will vary depending on the size and location of your business, the type of coverage you offer, and the age and health of your employees. However, there are some general guidelines you can follow when budgeting for employee health insurance.

For businesses with 50 or fewer full-time equivalent employees, the average cost of offering health insurance is about $5,200 per year per employee. For businesses with 51 to 500 employees, the average cost is about $4,700 per year per employee. And for businesses with 501 or more employees, the average cost is about $3,900 per year per employee.

Of course, these are just averages – your actual costs will vary depending on your specific circumstances. But knowing these averages can help you budget for employee health insurance and make sure you’re offering a competitive benefits package.

Strategies for Reducing the Cost of Offering Health Coverage to Employees

One of the most common concerns small business owners have about offering health insurance to their employees is the cost. There are a number of strategies you can use to reduce the cost of offering health coverage to your employees while still providing them with quality coverage.

One strategy is to offer a high deductible health plan (HDHP). HDHPs typically have lower monthly premiums than other types of health plans, but require employees to pay a higher deductible before their coverage kicks in. This can be a good option for small businesses that want to offer their employees health coverage but are on a tight budget.

Another strategy for reducing the cost of offering health coverage is to participate in a group health insurance plan. Group plans often have lower premiums than individual plans, and some small businesses may be eligible for discounts on their premiums if they participate in a group plan.

Finally, you can also consider using a Health Savings Account (HSA) to help offset the cost of offering health coverage to your employees. HSAs are savings accounts that can be used to pay for qualified medical expenses, and contributions to HSAs are tax-deductible.

best health insurance for small business

As a small business owner, you may be thinking that health insurance is too expensive to provide for your employees. However, there are many benefits to offering health insurance to your employees, including attracting and retaining talent, reducing absenteeism, and improving productivity.

When it comes to choosing the best health insurance for small businesses, there are a few things to keep in mind. First, you’ll want to consider the needs of your employees and what type of coverage they would most benefit from. Then, you’ll want to compare rates and coverage options from different insurers to find the best deal.

Finally, don’t forget to factor in employee contributions when determining the cost of health insurance for your small business.

- Summary of Money’s Best Health Insurance for Small Business Owners of 2023?

- United Healthcare — Largest Network of Providers

- Blue Cross Blue Shield — Best For Customer Service

- Elevance — Best Regional Networks

- Aetna — Best Preventative Care

- Kaiser Permanente — Best Prices

- Humana — Best Customizable Plans

- Cigna — Best for 24/7 Customer Service

How does health insurance for small business owners work?

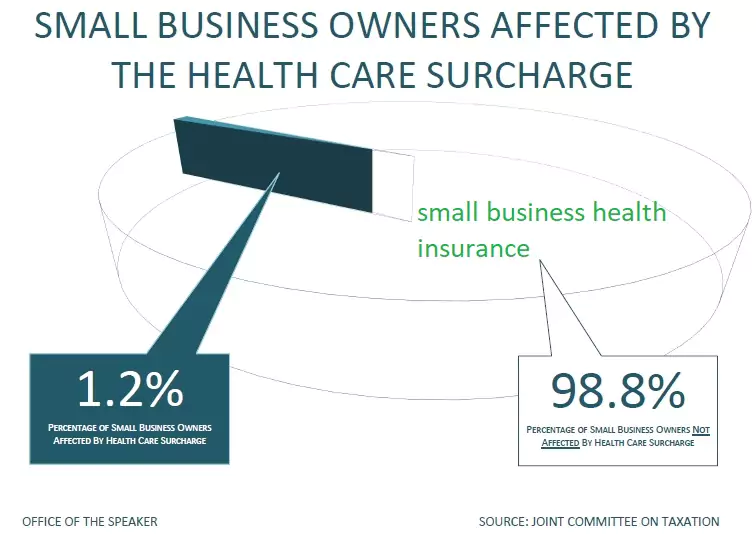

As a small business owner, you may be considering whether or not to offer health insurance to your employees. There are a few things to keep in mind when making this decision. small business health insurance

First, you’ll need to decide whether you want to offer a group health insurance plan or an individual health insurance plan. Group health insurance plans tend to be more expensive, but they also offer more coverage and benefits. Individual health insurance plans can be less expensive, but they may not offer as much coverage.

Second, you’ll need to decide how you want to pay for the health insurance. You can either pay the entire premium yourself, or you can have your employees pay a portion of the premium Third, you’ll need to choose a plan that meets your needs and your budget.

Fourth, once you’ve chosen a plan, you’ll need to enroll your employees. This process can be done online or through a paper application. Once your employees are enrolled, they will start receiving their ID cards in the mail.

fifth and final step is to start using your new health insurance plan! Be sure to keep track of any claims or expenses so that you can stay within your budget.